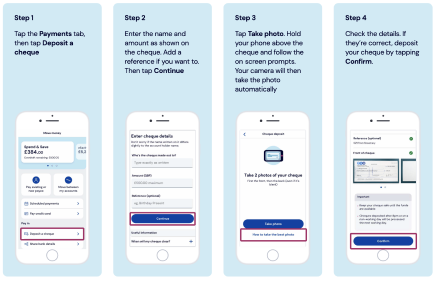

cheque deposit

Overview

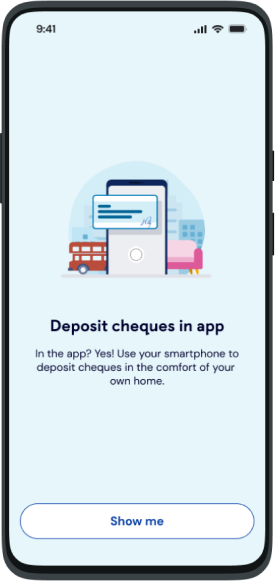

Retail and Business customers require an alternative to branch and post office to deposit cheques.

After the branch closure programmes in recent years, moving to a digital app experience was key for business strategy and user needs.

Customers ask for this functionality and service for every week as part of the NPS surveys, App store reviews and Chattermill analysis.

Design Process

Competitors

An in depth analysis of competitor journeys

Analysis included: E2E UX, Screen flows, Entry points, Number of steps, daily deposit limit, Individual Cheque Deposit limit, Instructions and guides, Funds ability time, Pros and cons, UI, copy and content, functionality, pre and post cheque information, transaction details.

User testing

User testing was conducted over several iterations. We used a framework to document our findings in the following format:

Experiment – Where we learned it, including platform, number of participants, types of tests, number of tests.

Facts – What we learned including success rates, pain points, ease of navigate, confidence of success rates.

Insights – Why we think that is, building hypothesis and theories based on facts and previous knowledge gained.

Recommendations – how we’ll proceed based on facts and insights and decisions made to iterate designs, entry points and flows for the best customer experience.

Experiment

- 1000 participants

- Userzoom platform

- TSB and non TSB customers

- Tailored support customers

Unmoderated

Surveys, TOLs, Click tests, cheque habits, business banking customers , the branch experience, what do they expect to see, likes and don’t likes

Moderated

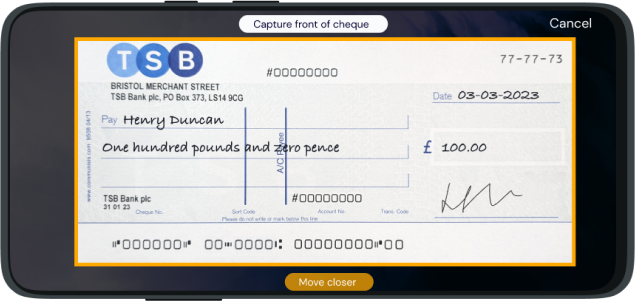

Prototype walkthroughs wireframes with customers, Layouts and flows - testing different iterations, unhappy paths and edge cases

Results

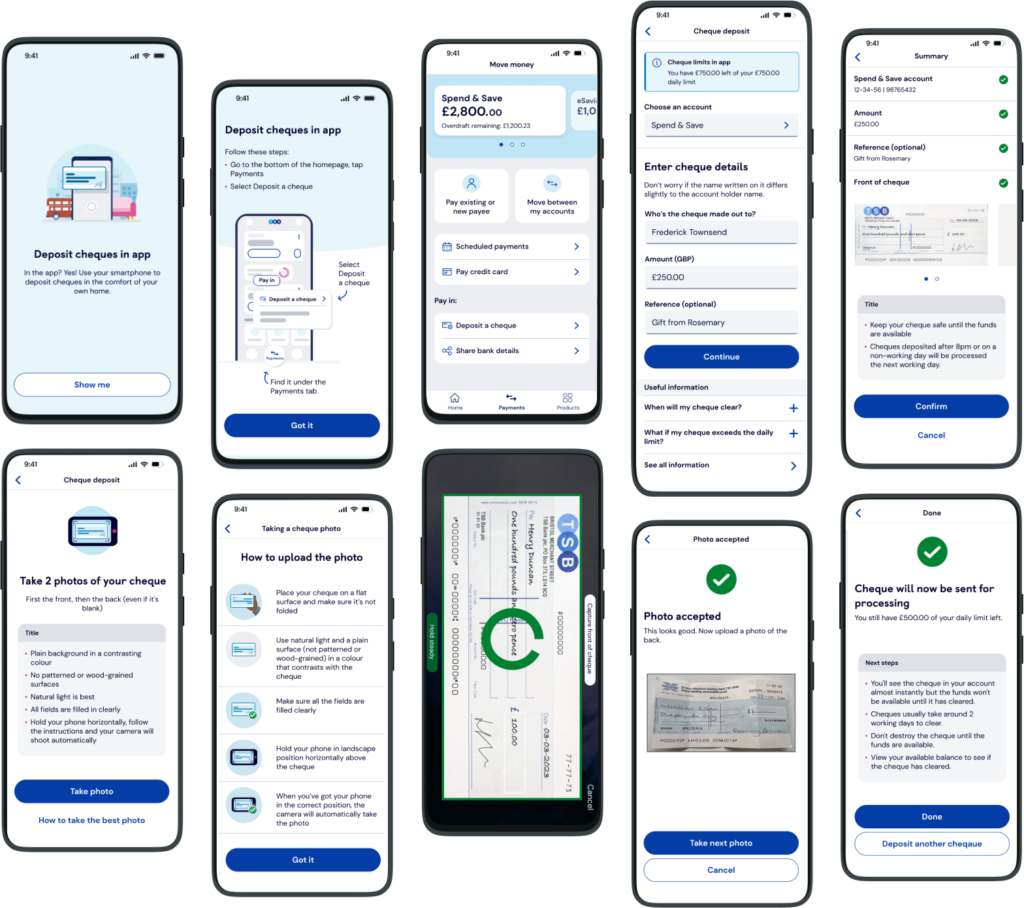

Entry points reviewed, simplified journey, extensive testing of third party apps, comprehension testing for cheque processing times.

Technical considerations

– Third party consultancy

– SDK integration

– Image valdiation

– Confidence score mapping

– Error handling

– Accessibility specs

Results

100,000 Cheques Deposited

Total amount since live (Jan 2024)

Increased digital adoption

– More customers using app to deposit cheques than branch

– Promotions in branch for digital assists with cheque deposits

Improved NPS

Most requested feature from customers month after month.

NPS Score 58.4 > 62.8 since Cheque launch.

Campaigns

– How to guides on tsb.co.uk

– Featured in TSB App tour

– Social media campaigns on TSB Instagram

– Branch poster suites

Postive customer feedback

– App store and Google Store comments

– Positive NPS Survey

– Reduced complaints

– Parity with competitors